Housing and Unemployment: Hardest-hit neighborhoods

July 31, 2020

By Sarah Berke, Colleen Ebinger, Justin Hollis, and Jacob Wascalus

The economic impact of the COVID-19 pandemic has put thousands of Twin Cities residents at risk of losing their homes. In fact, over the past four months, more than 400,000 workers in the region have filed applications for unemployment insurance. This is unprecedented in both quantity and speed.

We are at a critical juncture. The $600 federal supplemental unemployment benefit expires on July 31, and our regional unemployment rate is still above 9%. In a recent survey by HousingLink, most low- and moderate-income renters indicated they would have difficulty paying or would be unable to pay rent after the end of July if unemployment insurance benefits were not extended.

While the economic disruption has hit hard across our entire region, some communities and households are feeling the effect disproportionately and are at greater risk of housing instability.

In the absence of federal policy action to extend unemployment insurance, we hope to inform the focus of state and local COVID-19 emergency response efforts to prevent people from losing their homes.

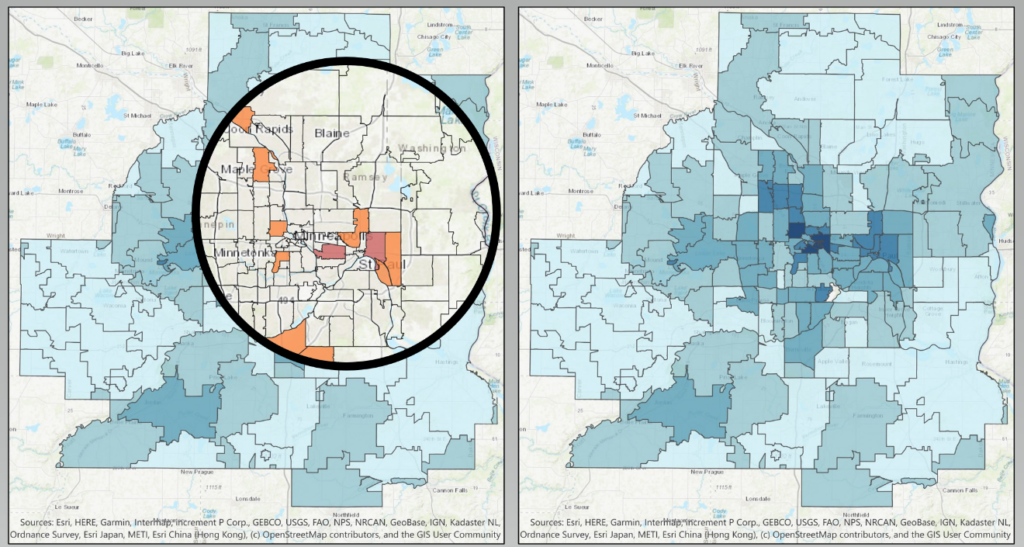

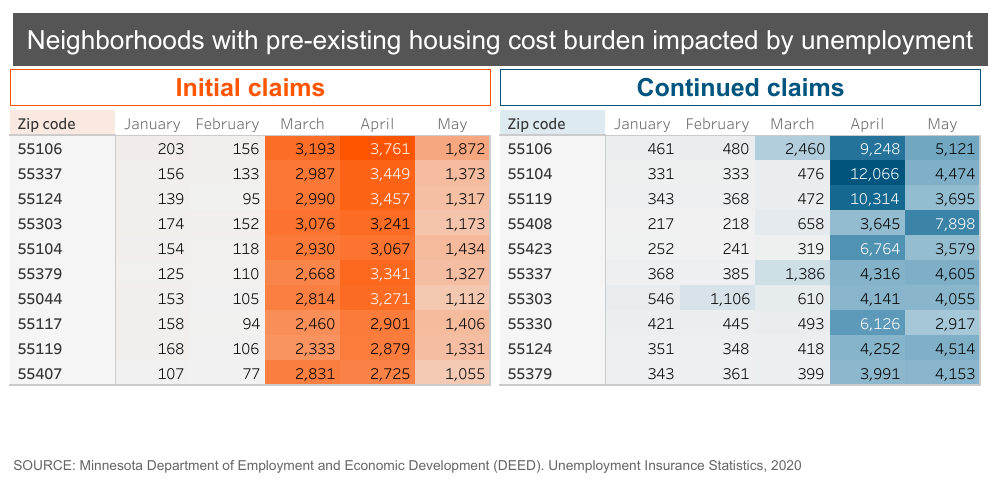

Some neighborhoods are hit hardest by the double whammy of job loss and housing cost burden

Looking at zip code-level data, we overlaid initial and continuing unemployment claims with what we already know about households who were struggling to pay for housing before the pandemic. We expect that a large number of the households on the brink of losing their housing reside in these areas. (It should be noted that this analysis does not speak to the impact of current economic conditions for those who were not participating in the labor market prior to this crisis.)

(Click here to explore these neighborhood dynamics on a map.)

Table 1.

In the east metro, the zip codes hardest hit by the twin crises of unemployment and housing cost burden (defined as paying more than 30% of their income on housing costs) are in central and eastern Saint Paul: 55104 (St. Paul: Midway, Frogtown, Union Park), 55106 (St. Paul: Dayton’s Bluff, Payne-Phalen), 55119 (St. Paul: Battle Creek – Highwood), and 55117 (St. Paul: North End, Thomas-Dale).

In the west metro, central Minneapolis neighborhoods and several suburban communities have been hardest hit: 55411 (Minneapolis: Near North), 55408 (Minneapolis: Lyndale), 55443 (Brooklyn Park), and 55303 (Anoka).

Other suburban areas highly impacted by both unemployment and high housing costs relative to income include 55379 (Shakopee), 55337 (Burnsville), and 55124 (Apple Valley).

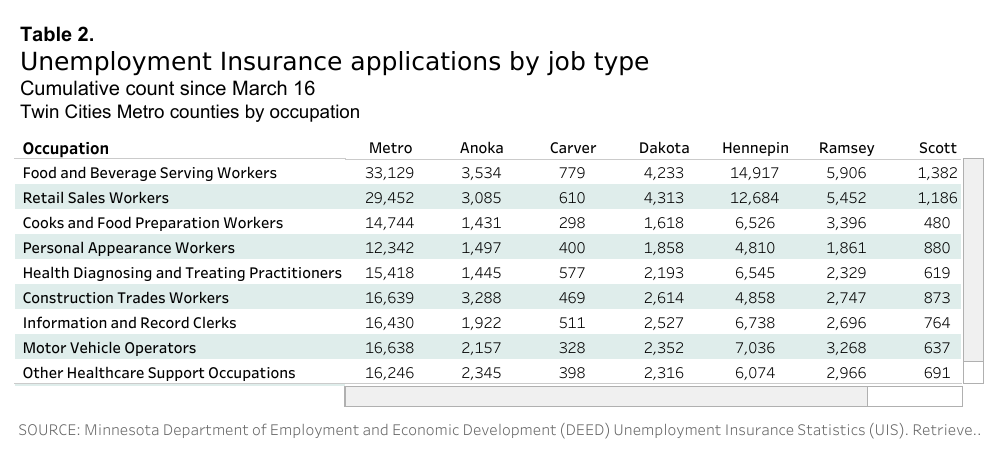

Workers in several job categories–i.e., beverage servers, retail sales workers, cooks and food preparation workers, personal appearance workers, and other kinds of production occupations–are particularly vulnerable to losing jobs due to the pandemic. Meanwhile, other low-income workers who are classified as “essential” remain employed. As a result, the distribution of the impact of job loss now is different than what we have seen in other recessions.

Households with children are experiencing unemployment at a higher rate and facing more housing pressure

Adults in households with children have been more likely to report permanent loss of employment since the start of the COVID-19 pandemic. According to the U.S. Census Bureau Household Pulse Survey between June 11th and June 16th, more than half (51%) of households with a child under the age of 18 reported having at least one adult lose employment income since the start of the pandemic, higher than the rate for all households (46%).

Moreover, adults in households with children were less confident in their ability to pay their rent or mortgage in July than adults who do not reside with minor children. Fifty-six percent of renter households with children reported “less than high confidence” in their ability to pay rent in July, higher than renter households without children (39%). Similarly, homeowners with children had less confidence than those without children in their ability to make July mortgage payments.

What we can do

Thousands of local families are at risk of losing their homes in the coming months without swift action.

- Extending the supplemental federal unemployment insurance benefit is the most urgent need to prevent people from losing their homes.

- Federal eviction and foreclosure prohibitions, which expired on July 24, will be most effective in stabilizing communities if paired with financial support for housing payments. Similarly, any extension of the Minnesota eviction moratorium should be paired with relief to stabilize renters and property owners alike.

- Minnesota recently allocated a portion of the state’s federal Coronavirus Aid, Relief, and Economic Security Act (CARES Act) funds to a new housing assistance program. But in the absence of more federal action, we know that it will not be enough to bridge thousands of households’ financial challenges through the months ahead. Given the anticipated high demand for limited state and local COVID-19 emergency response funds, leaders could prioritize their outreach for housing assistance and other interventions, such as foreclosure prevention counseling, to:

- Neighborhoods hardest hit by both housing cost burden and unemployment

- Workers in hard-hit service and hospitality job categories

- Families with minor children, who have been disproportionately impacted by job loss

Our analysis draws on these three sources:

- The U.S. Census Bureau’s Household Pulse Survey gives up to date insight into households’ financial situations and decision-making specific to the context of the current pandemic

- Minnesota Department of Employment and Economic Development (DEED) unemployment data shows where people make new and continued unemployment claims, down to the zip code level, throughout the metro

- American Community Survey data, also from the Census Bureau, tells us about the economic situation of households throughout the metro largely before the pandemic

About the authors

Sarah Berke is a program officer at the Family Housing Fund, focused on strategies to build and preserve affordable housing across region.

Colleen Ebinger is vice president of the Family Housing Fund, where she oversees programs, communications, and fundraising.

Justin Hollis is a research scientist with Minnesota Compass specializing in policy research and program evaluation, data science, and economic analysis.

Jacob Wascalus is a research scientist with Minnesota Compass working to improve community vitality by promoting the use of data and community indicators to measure quality-of-life.

Family Housing Fund seeks to catalyze change by working together with multiple partners and stakeholders to improve access, affordability, and resiliency across the entire Twin Cities housing sector.

Wilder Research, a division of Amherst H. Wilder Foundation, is a nationally respected nonprofit research and evaluation group. For more than 100 years, Wilder Research has gathered and interpreted facts and trends to help families and communities thrive, get at the core of community concerns, and uncover issues that are overlooked or poorly understood.