Pandemic Challenges Faced by Minnesota Landlords: New survey findings and recommendations to policy makers

Introduction

Throughout the COVID-19 pandemic and economic crisis, much of the housing policy discussion has been renter-focused. Many renter households have been unable to remain current on their financial obligations, falling further behind while a series of federal- and state-level executive orders extends moratoria on evictions for non-payment of rent. Several landlord surveys have tracked the change in late rent payments over time. However, those surveys have focused on owners of larger multifamily properties, with findings limited to the “hard numbers” of late rent payments and offering insight into the experience of one particular segment of the rental property owner perspective.

In September 2020, Family Housing Fund and HousingLink surveyed landlords managing smaller rental properties and smaller rental portfolios to gain insights into how these landlords perceive the rental crisis, its impact on their business, and their relationships with tenants. A primary goal was to fill the knowledge gap on rent payments for properties with fewer than five units and learn how landlords with small portfolios are weathering the pandemic.

These owners and properties play a critical role in our region’s rental housing stock. For example, in Minneapolis and St. Paul, 1-3 unit buildings comprise over 4 of 5 rental properties and 3 of 10 units. Owners of smaller properties often lease to a different renter population than owners of large multifamily properties, and smaller properties tend to offer more affordable rental options. For all of these reasons, it is critical to understand the experience of landlords managing smaller rental properties and smaller rental portfolios.

The results of the survey indicate real concerns among the small-rental market and suggest that the scope of the need has been underestimated. More than half of owners of smaller properties engaged in this survey said they have at least one unit with rent past due. Importantly, three in five landlord-respondents are considering a change to their business model if there is not additional assistance for renters or landlords, which suggests significant future instability in this part of the rental market. While greater detail on findings by portfolio size are outlined below, the full survey results offer three primary takeaways.

Key Findings on Challenges Faced by Landlords during the Pandemic

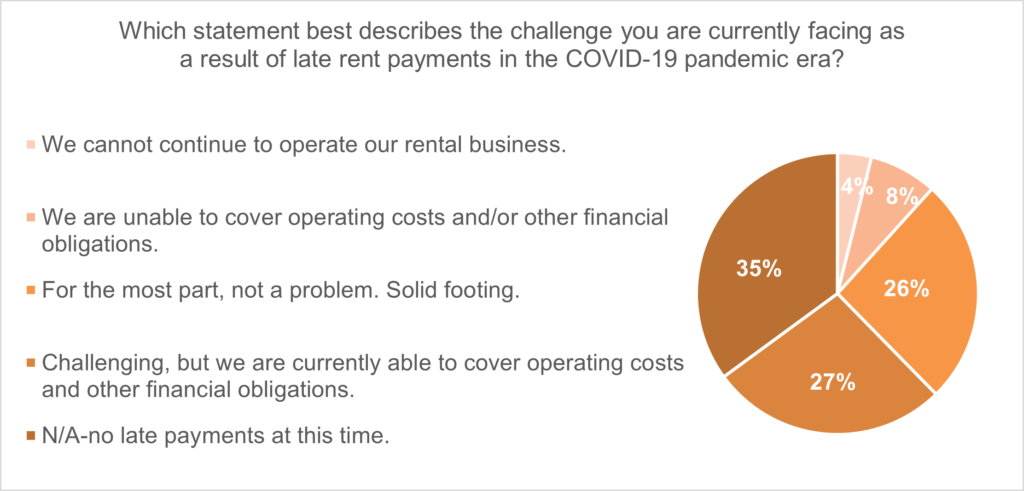

- Twelve percent of all landlord respondents reported an inability to cover operating costs and other financial obligations or an inability to continue operating their rental business due to pandemic-related challenges.

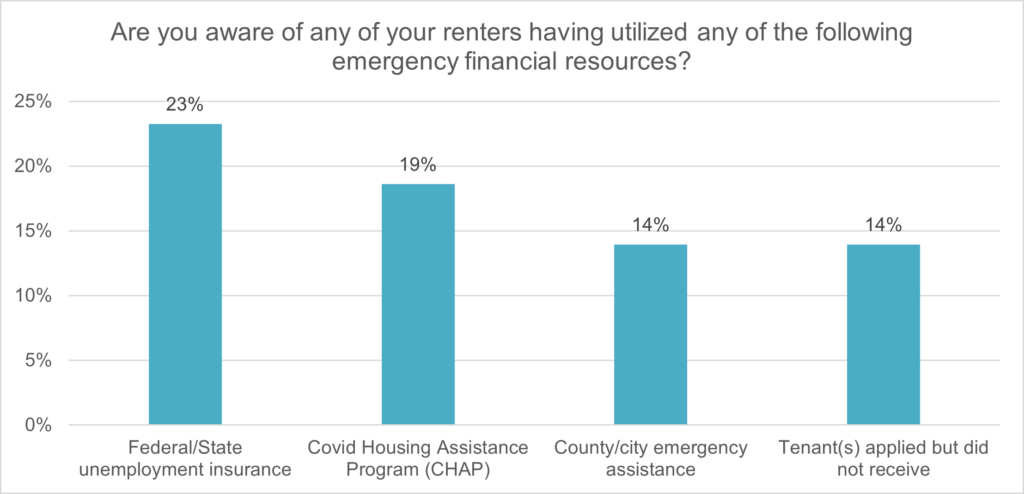

- Twenty-nine percent of landlord respondents report that their tenants have applied for one or more emergency financial resources. Fourteen percent report that their tenants applied but did not receive assistance, indicating there are tenants and landlords in need of support but unable to utilize available resources.

- If no additional rental assistance comes available, respondents indicated the following likely outcomes:

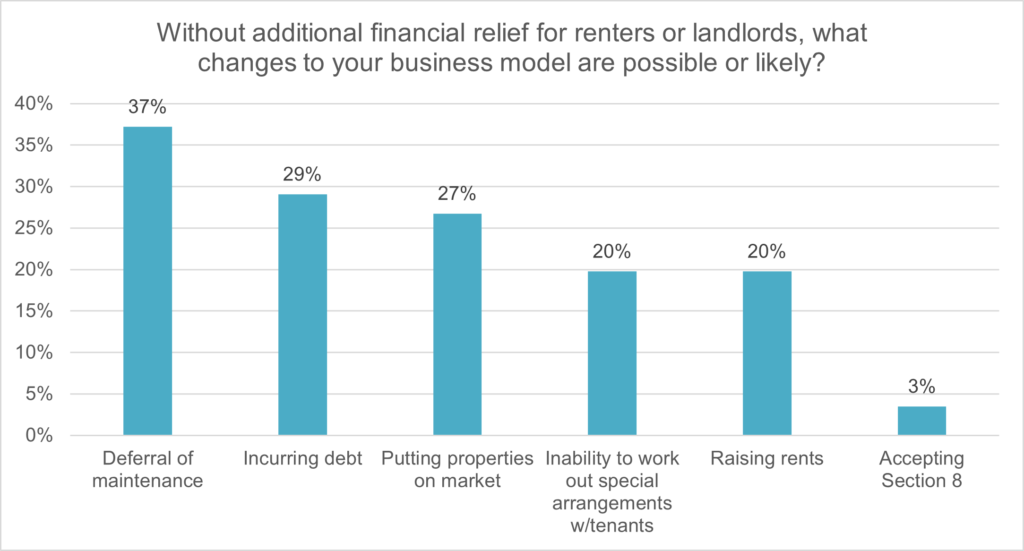

- Deferral of property maintenance (37% of respondents),

- Building owners incurring additional debt (29% of respondents), and

- Building owners putting their buildings up for sale (27% of respondents).

(Additional findings and analysis are provided further below.)

Recommendations for Supporting Minnesota Renters and Landlords Through the Pandemic

- Additional financial assistance is needed to ensure renters facing a COVID-related illness, job loss, or hardship are able to stay current on rent and remain housed, and to ensure landlords are able to cover their operating and maintenance costs. We recommend extending the additional unemployment insurance benefit or looking to the success of unemployment insurance to inform future assistance programs.

- Given the ongoing challenges of disbursing large-scale financial assistance to renters during the pandemic, policymakers should develop new opportunities for landlords to apply on behalf of all tenants in the owner’s rental property “portfolio” who are behind on rent, with appropriate provisions to protect those households from an eviction claim for the months of arrears resolved by the assistance.

- New resources and supports are needed to address the unique challenges facing owners of small rental properties, especially “small” owners of 50 or fewer units. These could include forgivable or low-cost financing to address repairs or deferred maintenance, and resources supporting alternatives to eviction, such as mediation services or help finding and navigating additional financial assistance.

Additional Findings on Challenges Faced by Landlords during the Pandemic

Landlords of small properties (fewer than five units) report past due rental payments:

- Fifty-three percent of respondents have at least one unit with rent past due, with the total number of past-due units representing 24% of all such units owned by these landlords.

- Thirty percent of respondents have at least one tenant with whom they have made special payment arrangements.

- Thirty-one percent of respondents have at least one unit for which they would have filed an eviction under ordinary circumstances (i.e. pre-pandemic, with no eviction moratorium).

Among all landlords surveyed, there are concerns regarding their business viability:

- Sixty percent of all respondents have had discussions with tenants regarding general financial concerns and help in navigating resources during the COVID crisis.

- While 88% of respondents are currently able to cover their financial obligations, 62% think a change to their business model is possible or likely if there is not additional assistance for renters or landlords. The following chart breaks out changes that respondents are considering (landlords could choose more than one answer).

- Twelve percent of all landlord respondents indicate an inability to cover operating costs and other financial obligations or, worse, an inability to continue operating their rental business. The full breakout of challenges landlords are currently facing are as follows:

- Sixty percent of all landlord respondents have had discussions with tenants regarding general financial concerns and help in navigating resources during the COVID crisis.

- Twenty-nine percent of landlord respondents report awareness of their tenants having applied for one or more emergency financial resources, broken out as follows.

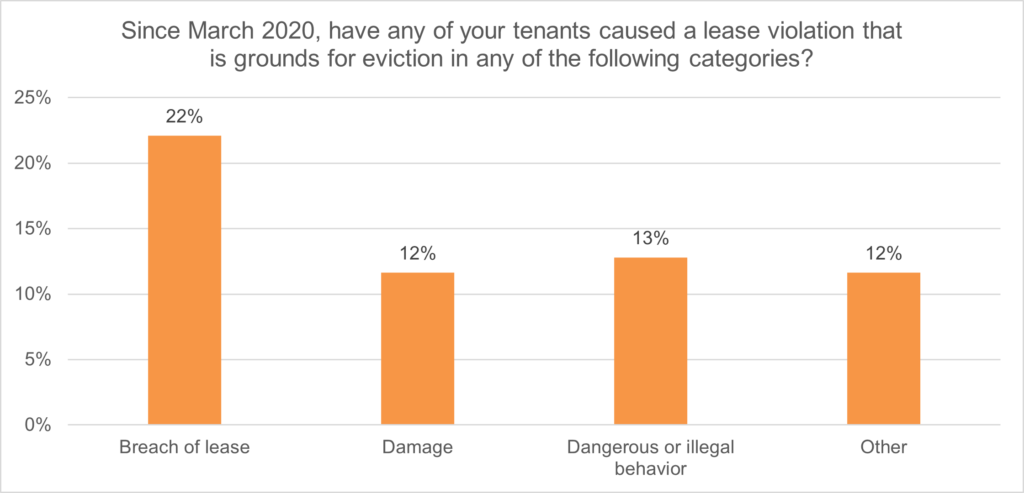

- Since March 2020, 40% of landlords report nonpayment of rent that would have been grounds for an eviction under ordinary circumstances. Thirty-one percent of landlords report additional types of lease violations during that time, broken out as follows (landlords could choose more than one response).

- Via open-ended comments: A common theme referenced tenants who are not behind on rent as a result of job loss or another COVID-related impact, but who landlords believe are not paying as a result of eviction moratorium protections or lack of clarity around whether rent is still due.

- Via open-ended comments: Many other challenges to regular business were reported by respondents, ranging from difficulty in filling vacant units, to additional costs or challenges related to cleaning or maintenance, to frustration with perceived lack of support from state, federal, or local government.

About the Survey Respondents

Small Property Landlords

- Sixty-one respondents reported owning properties with fewer than five units.

- Small-property landlord respondents report an average of 5.7 single family units per portfolio or 4.4 duplex/triplex/quad units per portfolio.

- Sixty percent of small-property landlord-respondents own properties in Minneapolis or St. Paul, 44% own properties in the Twin Cities suburbs, and 10% own properties in Greater Minnesota.

- Fourteen percent of those responding indicate that they live in a unit in one of their properties.

Medium/Larger Property Owners

- Thirty-four respondents reported owning properties with greater than five units.

- Larger-property landlord respondents report an average of 86 units in 5-20 unit property portfolios, 92 units in 21-50 unit properties, and 111 units in properties greater than 50 units in size.

- Sixty-four percent of larger-property landlord respondents own properties in the Twin Cities suburbs, 27% own properties in Greater MN, and 23% own properties in Minneapolis or St. Paul.

- Only one larger-property landlord respondent indicated owning Class A units, with 35 units in that property class. Respondents with Class B units average 142 such units across all their properties, and respondents with Class C units average 126 such units. Respondents with affordable units average 85 such units across all their properties.